F

#RetirementPlanning #SocialSecurity #FinancialLiteracy

www.fool.com

Can COLAs Really Keep Up With Inflation? Why I'm Not Relying on Social Security Alone in Retirement. | The Motley Fool

Social Security should only be one component of retirement income.

I'm not retired yet. However, planning for retirement should begin well before retirement, so I'm already getting ready for the day it comes.

F

#PersonalFinance #SavingsAccount #FinancialLiteracy

www.fool.com

This Might Be Controversial but Checking Accounts Are a Bad Place to Park Cash

Many or all of the products here are from our partners that compensate us. It's how we make money. But our editorial integrity ensures that our product ratings are not influenced by compensation.

F

#SocialSecurity #RetirementPlanning #FinancialLiteracy

www.fool.com

4 Social Security Changes Retirees Need to Know About in 2026 | The Motley Fool

One of these changes means bigger benefit checks, and another could slash checks by a lot.

One of the most important sources of your retirement income is likely to be Social Security, but it might not provide as much as you expect.

#DebtManagement #CreditCards #FinancialLiteracy

finance.yahoo.com

Credit card debt hits record $1.28 trillion. Here's why -- and how to get ahead of it.

Debt balances continue to rise, according to the latest data from the Federal Reserve Bank of New York. The latest quarterly report on household debt and credit shows that total household debt increased by $191 billion, or 1%, in the fourth quarter of 2025, to a new high of $18.

#TaxRefunds #EarnedIncomeTaxCredit #FinancialLiteracy

www.newsweek.com

Tax Refund Delay: Over 20 Million Americans Could Be Impacted

More than 20 million Americans could see tax refunds delayed due to a specific tax credit claim.

Those who claimed the Earned Income Tax Credit must wait until at least March 2 to get their refund, and if they choose to receive it as a check instead of as direct deposit, it could take even longer to arrive.

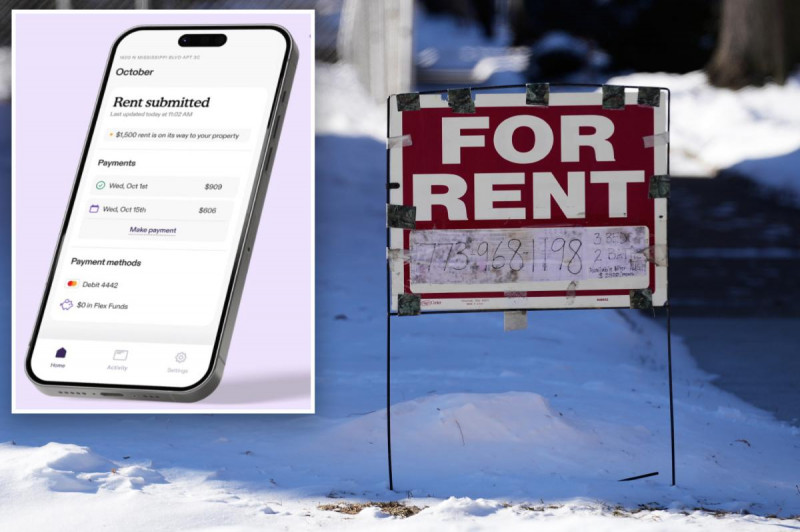

#RentRelief #FinancialLiteracy #HousingAffordability

nypost.com

'Rent now, pay later' services may help tenants manage monthly...

NEW YORK -- Rent can eat up an entire paycheck at the start of the month, so a growing number of renters are turning to a financial product that promises relief by letting them split the bill -- for a price.

#DebtRelief #FinancialLiteracy #CreditManagement

finance.yahoo.com

Debt settlement pros and cons: Is it the right move for you?

Plenty of Americans struggle to pay down debt -- from credit card debt to personal loans and car loans -- and rising balances can quickly catch up with your ability to pay.

#InvestmentAccounts #FinancialLiteracy #ChildrensFutures

www.newsweek.com

Trump wants kids to have investment accounts -- experts say it's complicated

President Donald Trump unveiled his administration's proposal for a new government-backed investment program for children this week, dubbed "Trump Accounts.

#FinancialLiteracy #InvestmentInTheFuture #EconomicGrowth

nypost.com

Trump Accounts are, for once, a REAL investment into the future of...

Unlike virtually every other government-spending program sold as an "investment in the future," Trump Accounts look to fit that bill -- with 401(k)-style investment accounts for newborns that can teach the value of saving (and the power of compound interest) from the cradle on.

#PersonalFinance #FinancialLiteracy #MoneyManagement

www.aol.com

Americans lost an average of almost $1,000 to financial errors in 2025. Here are 3 big money mistakes to leave behind this year

Americans are getting smarter with money, but financial mistakes still cost the average adult almost $1,000 each a year.

#FinancialLiteracy #PersonalFinance #CreditScore

www.aol.com

The One Daily Habit That Predicts Your Financial Health Better Than Your Credit Score

When it comes to financial reliability, your credit score often feels like the universal benchmark. When you apply for a loan, buy a car or take out a mortgage, your credit score is almost always part of the process.

#StudentLoans #FinancialLiteracy #DebtManagement

www.aol.com

NJ man stuck with $70K in student loans his dad took out. Ramsey Show hosts tell him how to fix 'messed up' situation with his debts and with his dad

It's one thing for a dad to support his son's college education. It's another to leave your adult child on the hook for a $70,000 student loan you take out on their behalf without telling them.

S

#FinancialLiteracy #CryptoEducation #MarketAwareness

www.streetinsider.com

Bybit Launches Program to Upskill Sri Lankan Creators with Fully Sponsored Market Education Program

DUBAI, UAE, Jan. 5, 2026 /PRNewswire/ -- Bybit, the world's second-largest cryptocurrency exchange by trading volume, has launched a fully sponsored market literacy education initiative aimed at supporting financial literacy and responsible market understanding among Sri Lanka-based creators, in partnership with Mastering the Markets.