#RetirementPlanning #GoldInvesting #ScamAwareness

www.cbsnews.com

Gold investing scams targeting seniors: Red flags every retiree should know

Millions of retirees are struggling right now as they watch their purchasing power erode amid a slew of issues, including persistent inflation, market volatility and general economic uncertainty.

F

#RetirementPlanning #FinancialSecurity #InvestWisely

www.fool.com

This Is the Single Biggest Threat to Your Retirement Security | The Motley Fool

If you are making this mistake, you are putting your retirement at risk right now.

You could be making a mistake right now that is putting your financial security in retirement in jeopardy.

F

#SocialSecurity #RetirementPlanning #FinancialAdvice

www.fool.com

Should You Claim Social Security at 62 or 70? A Study Offers a Clear Answer About the Best Age to Start Benefits.

The median worker aged 45 to 62 could increase their lifetime spending power by $182,000 by delaying Social Security retirement benefits until age 70.

F

#RetirementPlanning #SocialSecurity #FinancialLiteracy

www.fool.com

Can COLAs Really Keep Up With Inflation? Why I'm Not Relying on Social Security Alone in Retirement. | The Motley Fool

Social Security should only be one component of retirement income.

I'm not retired yet. However, planning for retirement should begin well before retirement, so I'm already getting ready for the day it comes.

F

#SocialSecurity #RetirementPlanning #LifeExpectancy

www.fool.com

New CDC Data Shows the Best Age to Claim Social Security for the Average Retiree

If you want to maximize your lifetime retirement benefits, the newest data from the CDC can help.

Social Security is the biggest source of income for most retirees.

F

#SocialSecurity #RetirementPlanning #FinancialLiteracy

www.fool.com

4 Social Security Changes Retirees Need to Know About in 2026 | The Motley Fool

One of these changes means bigger benefit checks, and another could slash checks by a lot.

One of the most important sources of your retirement income is likely to be Social Security, but it might not provide as much as you expect.

#SocialSecurity #HealthCareCosts #RetirementPlanning

www.newsweek.com

Social Security warning issued over rising health costs

A growing gap between Social Security benefit increases and the pace of health care inflation is putting future retirees at risk of losing much of their income to medical bills.

#RetirementPlanning #FinancialHealth #SocialSecurity

www.aol.com

Your golden years don't have to go down the drain -- here's how to keep your savings flowing strong through retirement

It's tempting to assume that your retirement date and your first Social Security check will arrive at the same time. But for many retirees, that's not how it works out.

#BabyBoomers #WealthTransfer #RetirementPlanning

www.newsweek.com

Boomers at 80: Why the "great wealth transfer" may never come

As America's first baby boomers begin turning 80, a generation that rode decades of economic good fortune is entering a new, more uncertain chapter -- one that will shape not just their own retirements, but the future of wealth, housing and opportunity for everyone who follows.

#Medicare #HealthcareCosts #RetirementPlanning

www.aol.com

8 Medicare Changes Every Enrollee Should Know About in 2026

According to the folks at Fidelity, a 65-year-old person who retired in 2025 could expect to spend $172,500, on average, on medical and healthcare expenses throughout their retirement.

#SocialSecurity #RetirementPlanning #FinancialShortfall

www.cnbc.com

Social Security has 'no bankruptcy or collapse in the cards,' economist says -- but benefits may change

Here's why the program faces a financial shortfall and how benefits may change.

Social Security, the federal social insurance program that millions of Americans rely on for income, faces a shortfall in funding it counts on from its trust funds.

#SocialSecurity #RetirementPlanning #FinancialWellness

www.aol.com

Social Security Recipients Will Lose This Much by Claiming at 62 Instead of 70 in 2026

Americans approaching retirement face a simple but high-stakes choice: when to claim Social Security.

For most people, claiming benefits at 62 instead of waiting until 70 means receiving about 40% less per month for life.

#Investing #RetirementPlanning #WealthBuilding

www.investopedia.com

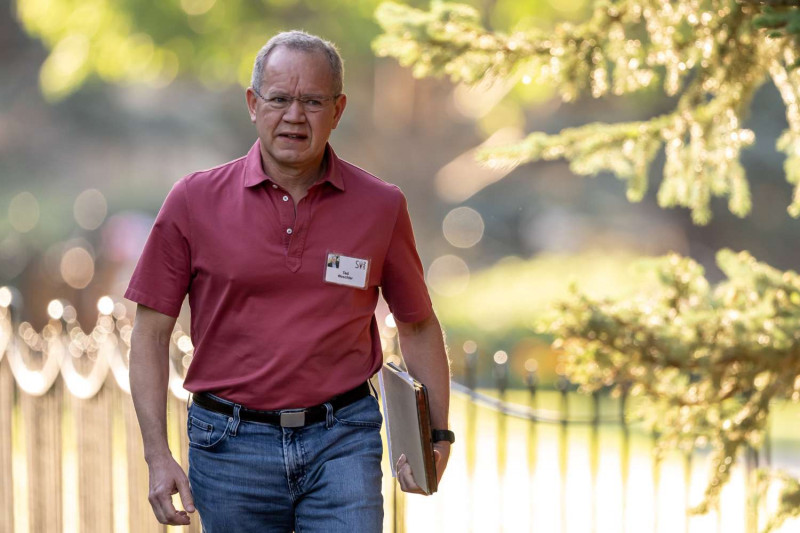

From $70K to $269M: How Warren Buffett's Protégé Used a Simple Habit to Achieve Success

It's been revealed that Weschler grew his retirement savings to more than $269 million, through exhaustive research, investing in stocks only, making concentrated bets, and focusing on long-term value.

F

#SocialSecurity #TaxChanges #RetirementPlanning

www.fool.com

High and Low Earners Will Feel the Biggest Impact of 2026 Social Security Changes | The Motley Fool

Social Security is changing, but not everyone will be affected in the same way.

Social Security is changing in 2026, with many rules looking different compared to last year.